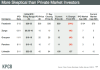

Earlier this morning at D10 KPCB analyst Mary Meeker showed a pretty definitive slide about the current state of the public markets with regards to tech companies. "The private market is in a bubble," Meeker said, "We have a $1 billion fund, and didn't invest once in Q1 because the valuations too crazy." The problem with these valuations is that public market investors are more skeptical, Meeker asserted bringing up the above slide comparing the IPOs of Facebook, Zynga, Groupon, Pandora and LinkedIn. Because of this skepticism their valuations are suppressed, almost all were trading at 20% lower than their initial IPO pricing, all except LinkedIn that is. The public market has taken kindly to the career focused social network, which is currently trading at $100 a share, 137% above its strike price of $32.

Earlier this morning at D10 KPCB analyst Mary Meeker showed a pretty definitive slide about the current state of the public markets with regards to tech companies. "The private market is in a bubble," Meeker said, "We have a $1 billion fund, and didn't invest once in Q1 because the valuations too crazy." The problem with these valuations is that public market investors are more skeptical, Meeker asserted bringing up the above slide comparing the IPOs of Facebook, Zynga, Groupon, Pandora and LinkedIn. Because of this skepticism their valuations are suppressed, almost all were trading at 20% lower than their initial IPO pricing, all except LinkedIn that is. The public market has taken kindly to the career focused social network, which is currently trading at $100 a share, 137% above its strike price of $32.december 21 2012 mayan calendar nfl playoff picture nfl playoff picture rose bowl 2012 sat cheating scandal hangover cure

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন